Table of Contents

Introduction

Globalization means that countries are becoming more connected to the global economy. In the case of underdeveloped countries like India, this is important because it can help improve their economic situation. We can see this by looking at examples like East Germany, Poland, and the former Soviet Union, which used to have closed economies and struggled economically. In contrast, countries like Singapore, Taiwan, Hong Kong, and South Korea, which embraced openness and globalization, have done well economically.

To make this work for underdeveloped countries, they need to change their approach. They should focus on achieving a balance between things like demand and supply, savings and investment, revenue and spending, and exports and imports. This will help them address problems like poverty, unemployment, and inequality. Globalization can be a solution to these challenges, so many countries are choosing to participate in the process.

These countries are making significant policy changes to make their economies more market-friendly and open to foreign capital, technology, and companies. The goal is to become more efficient, increase productivity, and connect their economies with the rest of the world. This way, they can work toward solving their economic issues and improving the lives of their people.

Meaning of Globalisation

Globalisation simply means integrating the economy of the country with the world economy. Globalisation embodies the integration of international markets for goods, services, technology, finance, and labour. It is underpinned by the opening up of national economies to global market forces and a corresponding reduction in the scope of the government to stage national macroeconomic policies. Indeed, the ‘end of geography’ symbolizes the thrust of globalization with far-reaching implications for national, regional, and open economics.

In current economic literature, the term Globalisation is used to mean a more liberal “Outward of ented policy”, which includes eliminating export blades, lowering very high import tariffs, and placing lesser reliance on quantitative restrictions on imports. However, it can be said that the outward-looking policy does not mean the government would completely abandon all forms of control and place the entire economy at the mercy of multinationals. The main aim of the policy of globalization would be to remove certain imbalances and restrictions that hamper the free flow of trade.

Definition

(1) In the words of Rubens Ricupero (Secretary General of the United Nations Conference on Trade and Development), “Globalisation is the integration of the world economy as the result of three main forces be increase in trade in goods and services,

(i) The increase in the investment of transnational companies the consequent change like production. Production is no longer national but access that takes place in different countries.

(ii) The economy is open to foreign capital, foreign technology, and free competition. Free World Trade Exports and Imports are liberalized. Elimination of Tariffs and Quotas.

(iii) Free Flow of International Capital.

(2) According to eminent economist Deepak Nayyar, “Globalisation may be defined as a process dated with increasing openness, growing economic interdependence and deepening economic inte- on in the world economy.”

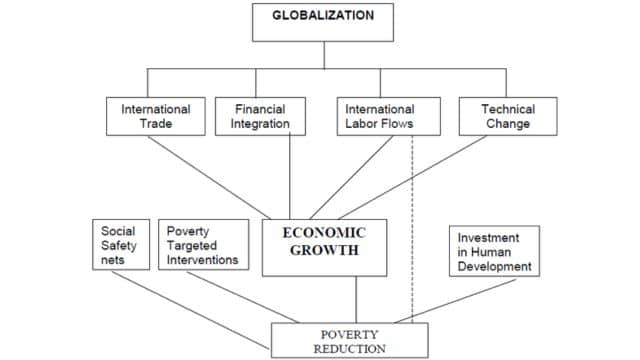

Indications or Dimensions of Globalisation

Over the last 25 years, the process of globalisation has spread rapidly. During this period, there has substantial development in the fields of international finance, trade, and capital investment. Rapid exversion of this process has resulted in the following important changes in the economies. These changes are the main indications of the process of globalisation.

(1) International Trade: A large volume of world production is entering world trade. Most of the odd trade takes place among firms that co-operate in the international field. The share of intra-firm trade has increased from 20 percent to 33 percent in world trade. The share of world trade in the world’s gross domestic product has risen from 12 percent to 18 percent.

(2) International Investment: The percentage of international investment has also been looked up. Between 1980 and 2002, foreign direct investment (FDI) increased from 4.8 percent to 12.6 percent of production. Foreign direct investment rose from 2 percent to 7 percent of the world’s gross capital formation.

(3) International Finance: The International finance sector has developed very rapidly. The finance sector dominates the trade and investment sectors. There has been a startling expansion of the foreign money market. According to 2002 statistics, transactions worth $ 1300 billion were taking place daily in this market as against $ 60 billion every day in 1983.

Causes of Globalisation

The following are the main causes of the emergence of globalisation:

(1) Policies of Liberalisation: Pursuance of policies of liberalization by different countries will account for the growth of globalisation. As a result of these policies restrictions on international economic transactions were removed. With the removal of these constraints, the road to globalisation was all clear. The impact of openness was witnessed in the trade sector. It was followed by foreign direct investment. Libel policies were also adopted in the financial sector subsequently.

(2) Technical Revolution: The revolution in the fields of transport and communication has rendered the world a small place to live in. Jet aircraft, computers, satellites, and information technology all have served to remove frontiers of time and space. Besides, the cost of transmission and reception of information has fallen considerably.

(3) New Forms of Industrial Organisation: The Development of new management techniques in industrial organizations has also accelerated the process of globalization. On account of the nature of technical progress, the falling share of wages in the cost of production, the increasing importance of mutual closeness between producers and consumers, etc, firms are in a dilemma to choose between foreign trade and foreign dried investment to participate in expanding the international sector.

(4) Experience of Developing Countries: Over the last two or three decades, centrally planned economies like Russia, Eastern Europe, Eastern Germany, etc. have failed on the economic front. These economies were hesitant to adopt the process of globalization. On the contrary, those developing economies like Korea, Thailand, Taiwan, and Hong Kong. Singapore etc., which adopted the process of globalisation achieved new heights of economic success. China also succeeded in achieving a high rate of economic growth by resorting to the process of globalisation. These success stories of globalisation inspired India and other countries to globalize their economies.

(5) Emergence of the United States as a Super Power: The success of globalisation is conditioned by the existence of a superpower whose currency is universally acceptable. Since 1970 along with the beginning of the process of globalisation, America has been emerging as a superpower in world polity. The disintegration of Russia and the triumph of capitalism rendered America a superpower. Political supremacy in America has also been instrumental in hastening the process of globalisation. The existence of a superpower is indispensable for the process of globalisation. It is the currency of such a superpower that facilitates the smooth running of international markets. This role is being played by America.

Merits of Globalisation

The supporters of Globalisation have put forward a member of arguments in favor of Globalisation. They are as under.

(1) Flow of Foreign Capital: Globalisation will encourage the flow of foreign capital in the form of direct foreign investment, commercial borrowings, collaborations, etc. Transference of capital from developed to underdeveloped countries will be mutually beneficial. The developed countries have surplus capital. Globalisation helps in the flow of surplus capital from developed countries to underdeveloped countries. As a result of this transference of resources, developed countries earn profit and in the case of underdeveloped countries, investment in productive activities increases. Underdeveloped countries suffer from a lack of capital. The need for capital has increased to accelerate the role of economic growth. Since saving does not increase in the same ratio as income does, this void is filled by the flow of foreign capital. Thus to increase the ability of capital to the desired extent role of foreign capital has been creditable.

(2) Entry of Multinational Corporations: Globalisation encourages the entry of multinational corporations. These corporations have a unique and empirical capacity to increase production and distribution. Wherever they go they make radical changes in the existing production system of that country, their superior technology, professionalism, managerial competence, and quality are of paramount importance to the country. These corporations bring modern technology with them. They can offer investment in research and development (R and D). As a result process of research is initiated. These corporations apply innovations to underdeveloped countries through their subsidiaries.

(3) Increase in Efficiency: Burton has established that Globalisation would result in better capacity utilization and economies of scale. Most studies support the hypothesis that there is a positive relationship between the degree of openness and economic efficiency. Efficiency means to minimize costs and maximize profits. Globalisation leads to privatization and competition. Both of which promote efficiency. The goal of privatisation is to earn profits and this goal can be achieved only when the firm can minimize the costs. A firm can face the competition and survive in the free market only when it can provide quality products at competitive prices. This requires efficient production.

(4) Increase in Knowledge: Rapid increase in knowledge through globalisation provides a new potential for developing countries to grow faster. The knowledge explosion is driving technical change, which is changing the nature of global interaction and competition. Unless the developing countries move rapidly to join the fast-moving global economy, the information that supports it will widen the gap between rich and poor countries. The developing countries must develop a strategy for using the growing knowledge base which must be tapped internationally. In short obalisation results in the diffusion of knowledge for the benefit of all. Multinational corporations which are the important organs of globalisation impart training to local employees with respect to modern techniques of production, marketing, financing, exports, etc.

(5) Availability of Modern Technology and Marketing: Modern technology and managerial Services are made available to enterprises established in different parts of the globe by multinational corporations. As a result, the productivity of these enterprises increases and resources are optionally utilized. It is due to globalisation that technology has been transferred from developed countries to developing countries. The multinational corporations which flourished in this era of globalisation make available marketing vices, especially export-related marketing research, advertisement, the spread of marketing information, range facilities, transport, packing designs, etc.

8) Develops World Trade: Globalisation has extended world trade. The establishment of the World Trade Organisation in 1995 aimed to discourage bilateralism and encourage multilateralism. Globalisation is reflected in the rising share of international trade in world output. The volume of world merchandise trade is estimated to have increased at an annual rate of more than 6 percent, compared with an output growth of less than 4 percent. This means that each 10 percent increase in world output has on average been associated with a 16 percent increase in world trade. On account of globalization, world trade and investment barriers fell rapidly. There was a dramatic decline in transportation and communication costs.

(9) International Division of Labour: Globalisation means that different activities happening all over the world are working together. It’s like a big puzzle where each piece is in a different place. For example, when making a product, it’s not all done in one country. It’s split into different steps, and each step might happen in a different country. This helps companies access the things they need and reach new markets.

This way of doing things gives developing countries more chances to be good at the parts of making things that need a lot of workers, even if the whole process usually needs a lot of money. It lets them be part of global trade, and it’s not limited by geography or borders.

For example, a toy maker in the United States might make a deal with a company in Hong Kong to work together in China. They use materials from Malaysia and then send the finished toys back to the United States. The idea is to be able to get what you need from anywhere in the world to make things and sell them in different countries.

Demerits of Globalisation

The opponents of globalisation have extensively criticized it in a variety of ways. The demerits globalisation may be summed up as follows:-

(1) Cut-throat Foreign Competition: Critics are concerned that globalization will create intense competition between countries. This could make countries less independent in political, social, and economic matters. Multinational corporations might use their power to benefit themselves, which could harm poorer nations.

These big companies use advanced technology to produce goods at lower prices and compete with local producers. When they outcompete local businesses, they take control of the market. Their resources, technology, and management make it hard for local industries to compete for long.

Competition can be good, but it’s only fair when developing countries realize that the wealthy countries often take more from the poor than they give. The rich become richer at the expense of the poor, and development can come at the cost of tough competition with less developed nations.

(2) Causes of Economic Inequality: It has further been criticized that globalisation will economic inequality. Globalisation leads to the growth of multinational corporations. have proved harmful to the goal of economic equality, in more than one way.

(i) Regional inequality has been further aggravated because of them. MNCs are interested in setting up industries in particular regions and hence those regions develop very rapidly and other regions remain undeveloped.

(ii) MNCs pay more sales and perks to their employees than other employees. This widens the gap between the income of the Aurers, giving rise to economic inequality.

(iii) These corporations give more importance to the pro- of luxury goods than the production of mass consumption goods. The reason is that it is more profitable to produce the former than the latter. Thus the scarce resources of the country are not put to optimum use.

(iv) These corporations further accentuate rural and urban disparity. By setting up their Antries in urban areas they encourage villagers to leave their villages and settle down in urban areas. In short, globalisation leads to inequality and exploitation.

(3) Increase in Debt Burden: Globalization can make things tough for developing countries. One big problem is that it can increase their debt, and being heavily in debt is really hard. This can lead to a situation where it’s almost impossible for them to get out of debt, like being stuck in a financial trap.

Dealing with debt is a big issue for many developing countries. They have to use a significant portion of their money from selling things to other countries to pay off their debts. This means there’s less money available for their own economic growth.

Paying off these debts not only affects how much a country can develop, but also how quickly it can do so. It’s a heavy burden on their ability to manage their finances.

In fact, servicing these heavy debts can make the financial problems of heavily indebted countries even worse. Because of globalization, the amount of money they have to pay as a part of their total economic output is going up quickly. And finding ways to reduce these payments can be expensive. This whole situation creates uncertainty, which makes people and businesses less confident, and that can discourage private investment, making it even harder for these countries to grow economically.

(4) Adverse Effect on Balance of Payments: Globalization has negatively impacted the balance of payments of underdeveloped countries. Their increasing imports of capital goods and intermediate products strain foreign exchange reserves. Declining export terms and dependence on primary commodities worsen the situation. Food shortages and external factors exacerbate the problem. While international organizations advocate free markets, developed countries’ protectionist policies harm developing economies’ balance of payments.

(5) Increase in Consumerism: Globalization, driven by Western-style consumerism, prioritizes luxury cars and five-star hotels over mass transport and affordable housing. This shift towards conspicuous consumption discourages savings, leading to economic crises in East Asian nations like South Korea, Thailand, and Malaysia. Globalization’s demonstration effect, with foreign capital and lifestyles, distorts resource allocation, stirs social discord, and heightens tensions among society’s various classes.

(6) Element of Uncertainty: Globalisation is expected to promote the flow of foreign capital. However, an element of uncertainty looms large in respect of foreign capital. It may be reprinted at any time. Hence foreign capital can never be a permanent part of an economy. At a time of crisis when foreign capital is needed the most, the availability becomes scarce. South East Asia’s recent economic crises an ample testimony in favor of this argument. When the so-called economic tigers of East Asia were in dire need of foreign investment the flow of foreign capital was not available. This made their crises worse. The workers and trade union leaders fear that globalisation will lead to unemployment. This also leads to uncertainty in their work culture.

Globalisation of the Indian Economy

To pull the country out of the economic crisis, the government of India, in 1991 sought financial assistance from the International Monetary Fund and World Bank. These two international institutions imposed on India the conditionality of implementation of the Stabilisation and Structural Adjustment Programme to secure the said assistance. It was to fulfill these conditions that India introduced the New Economic Policy in 1991. The process of globalisation in India was the outcome of this policy. Two parts of the conditions laid down by international institutions were:

(1) Stabilisation: Stabilisation refers to the situation of an economy wherein inflation and balance of payments deficit are kept under control. To achieve this objective it is essential to scale down the deficit and rate of money supply. It is a stable economy that attracts foreign investment.

(2) Structural Adjustment Programme: It refers to the structural adjustment of the economy as the basis of the policy of liberalization. It has two aspects:

(i) Internal: In the domestic sector liberal policy is adopted for adjustment of investment, production, prices, etc. Government controls should be minimized in this regard and ultimately the same be moved.

(ii) External: Government control over the flow of foreign goods, services, capital, technology, vestment, etc, should be reduced to the minimum. It implies the liberalization of foreign economic policy and globalisation of the economy.

In short, it was in 1991 that the process of globalization of the Indian economy was initiated under the pressure of international financial institutions referred to above. As a result, government interference in economic activities declined. The policy of liberalization has been adopted in respect of international trade, foreign investment, and foreign capital.

Characteristics of Globalisation of the Indian Economy

The main characteristics of globalisation of the Indian economy are as under:

(1) Globalisation of Trade: It means a reduction of government controls over international trade and the adoption of liberal policy with respect to imports and exports Since 1991, the government of India has been pursuing the policy of liberalization to achieve the objective of globalisation of trade under new econo play. To liberalize, foreign trade from the control of government and to allow its growth in a macher, the following steps have been taken.

(i) In July 1991, the Indian rupee was devalued by 22 percent in two installments so as to let the rupee find its real exchange rate.

(ii) In 1993-94, full convertibility on trade accounts was enforced and an integrated exchange rate system was adopted.

(iii) In 1994-95 full convertibility on current account was enforced. It implies the freedom to buy and sell foreign currency for International transactions on the current account.

(iv) Restrictions on imports and exports have been reduced. Impact of several goods have been put under the open general license (OGL) category Import restrictions on several have been withdrawn

(v) Quantum of import duties has been lowered.

(vi) In the Export-Import Pol- 2000-2001, restrictions on the import of 751 items have been withdrawn. In 2001-2002 the import of all ods will be made free.

(vii) According to Export Import Policy 2000-2001, old machines could be imported for the next 10 years without a license.

(2) Globalisation of Investment: It means the removal of restrictions on foreign investment and ng concessions to attract the same. In the new economic policy of 1991, the government liberalized foreign cement policy and took the following measures in this respect:

(i) In 1991, foreign capital investment of up to 51 percent was allowed in 34 priority industries- without prior approval of the government.

(ii) In 1996, foreign direct investment of up to 74 percent was allowed in 9 industries. Foreigners are allowed to take profit on investment to the country of origin.

(iii) If foreign companies want full ownership of joint ventures in India or want to set up subsidiary companies with full ownership, they will be free to do so.

(iv) Restrictions on the transference of shares by one non-resident Indian (NRI) to another non-resident has been withdrawn.

(v) Foreign investors are allowed to disinvestment equities at market price. They are free to remit the proceeds of disinvestment to the country of origin.

(vi) Several concessions and facilities have been given on foreign direct investment for the development of infrastructure viz. roads, power, communications, etc. Hundred percent equity has been allowed in powerhouses.

(vii) Multinational Companies (MNCs) have been given many concessions to set up export-oriented bs in the country.

(viii) The Foreign Investment Promotion Board has been established to provide single window facility approval of the foreign investment.

(x) Non-resident Indians are allowed 100 percent investment in Export Houses, Trade Houses, petals, Export-oriented units, Hotels, etc.

(x) In the Export-Import Policy 2001-2002, foreign and multinational companies are allowed 100 percent investment in Special Economic Zones.

(xi) The New Insurance Act provides for 26 percent foreign investment in the share capital of private sec companies.

(3) Globalisation of Finance: As a result of Economic Policy 1991, liberal policy has been opted in respect of international finance. International finance refers to foreign governments, international institutions, commercial borrowing, grants, and investment. It also includes foreign financial institutions- and foreign banks. It is the policy of the government to minimize restrictions on foreign capital flow to provide diverse facilities for the setting up of foreign banks and other financial institutions. The following assures have been taken for globalization of international finance:

(i) Companies governed by the Foreign Exchange Act have been allowed to borrow or accept deposits without the permission of the Reserve Bank of India.

(ii) Foreign Institutional Investors (FII) are allowed to invest in the Indian capital market.

(iii) Efforts are afoot to mobilize deposits of non-resident Indians.

(iv) Indian Financial Institutions like the State Bank of India, have sold India Resurgent Bonds to mobilize foreign capital.

(v) Many facilities have been offered to foreign banks to establish themselves in dia.

In short, the globalization of the Indian economy has been progressing rapidly.

Frequently Asked Questions (FAQs)

What is the aim of globalisation?

The aim of globalization is to promote economic integration, cultural exchange, and the free flow of goods, services, and information across national borders, fostering interconnectedness and cooperation in a globalized world.

What are the main features of globalisation?

Key features of globalization include increased cross-border trade, investment, and information exchange; interconnected financial markets; cultural exchange; technological advancements; multinational corporations; and the spread of Western consumer culture, impacting economics, societies, and cultures worldwide.

What is the scope of globalization?

Globalization encompasses economic integration, cultural exchange, technological advancement, political cooperation, and the interconnectedness of nations, transcending borders and fostering a more interdependent global community.

What are the 2 advantages of globalisation?

1. Economic Growth: Globalization can lead to increased economic growth by facilitating trade and investment, creating job opportunities, and fostering innovation.

2. Access to Diverse Products and Services: It allows consumers to access a wide range of goods and services from around the world, promoting choices and improving quality of life.

Read Also:

- Economic Laws | Types, Features or Nature

- Production Management | Objectives, Functions, Production Planning & Control

- Economics For Engineers Book PDF

- Total Quality Management | History, Importance, and Characteristics

- Energy Management | Need and Environmental Aspects

Leave a Reply